Invoice Billable Items

This document outlines how to manage Invoice Billable Items within SecurityTrax, which are used in conjunction with SecurityTrax' Invoicing feature.

Terms

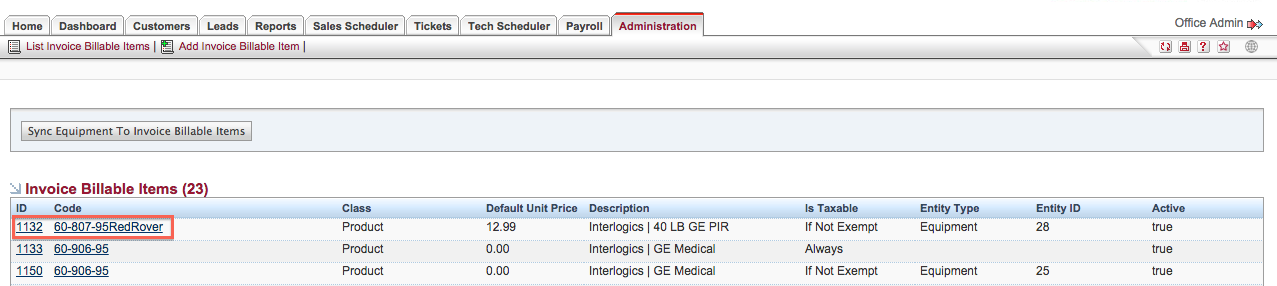

On the Invoice Billable Items page, you will see a list of all Invoice Billable Items already present within SecurityTrax. The information in this list is detailed below.

ID

The unique identifier for the Invoice Billable Item, set by SecurityTrax when the Invoice Billable Item is created.

Code

The Code/Name of the Invoice Billable Item.

Class

The Class of the Invoice Billable Item (product, labor, service, etc.)

Default Unit Price

The price-per-unit that the Invoice Billable Item is to be billed at, unless overridden on a specific Invoice.

Description

The description of the Invoice Billable Item.

Taxable

One of three options: 1. If Not Exempt: the Invoice Billable Item is taxable unless an exemption is specified in the Sales Tax Settings (see below). 2. Always: The Invoice Billable Item is always taxable, regardless of Sales Tax Settings. 3. Never: The Invoice Billable Item is never taxable, regardless of Sales Tax Settings.

Entity Type

If this Invoice Billable Item was created by SecurityTrax, the Entity Type reflects the type of item the Invoice Billable Item represents (for example, Equipment).

Entity ID

If this Invoice Billable Item was created by SecurityTrax, the Entity ID reflects the ID of the item the Invoice Billable Item represents (for example, if the Entity type of the Invoice Billable Item is "Equipment" and the ID is "1", this Invoice Billable Item is associated with the piece of Equipment with ID 1).

Active

Whether or not this Invoice Billable Item is active within SecurityTrax and will appear as an option when creating an Invoice/Quote for a customer.

Invoice Billable Items

Using the Invoices feature within SecurityTrax to bill a customer for labor, a service/product etc. requires that you first create an Invoice Billable Item pertaining to whatever you are billing the customer for.

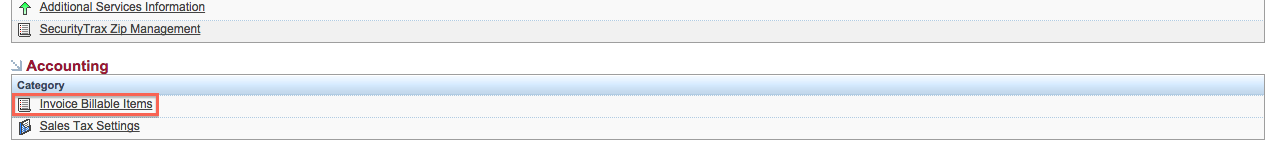

To begin this process, go to the Administration tab then, in the Accounting section, click on the link "Invoice Billable Items".

Creating & Editing Invoice Billable Items

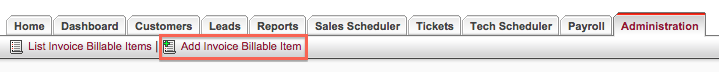

To create an Invoice Billable Item within SecurityTrax, navigate to the Administration Tab -> Accounting Section -> Invoice Billable Items link -> Add Invoice Billable Item link (near the top of the page).

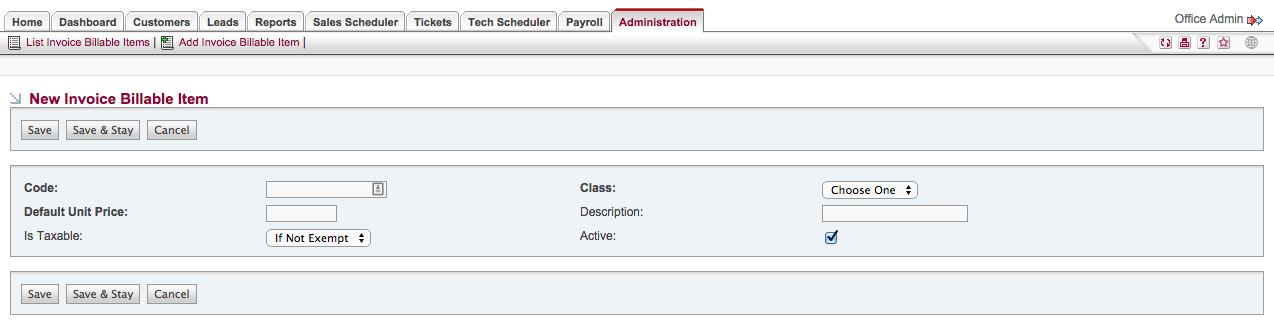

The page to add an Invoice Billable Item has several fields, a description of these fields is below.

Code

Required Field. The Code/Name of the Invoice Billable Item

Class

Required Field. The Class of the Invoice Billable Item (product, labor, service, etc.).

Default Unit Price

Required Field. The price-per-unit that the Invoice Billable Item is to be billed at, unless overridden on a specific Invoice.

Description

The description of the Invoice Billable Item.

Is Taxable

One of three options: 1. If Not Exempt: the Invoice Billable Item is taxable unless an exemption is specified in the Sales Tax Settings (see below). 2. Always: The Invoice Billable Item is always taxable, regardless of Sales Tax Settings. 3. Never: The Invoice Billable Item is never taxable, regardless of Sales Tax Settings.

Active

Whether or not this Invoice Billable Item is active within SecurityTrax and will appear as an option when creating an Invoice/Quote for a customer.

To Edit an Invoice Billable Item, click on the Invoice Billable Item's "ID" or "Code" in the list of Invoice Billable Items, edit the Item as desired, then click "Save" or "Save & Stay"

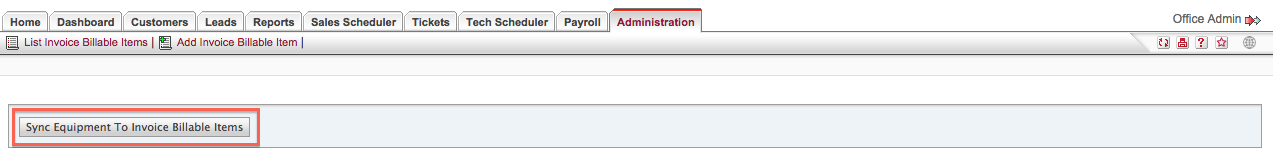

Sync Equipment To Invoice Billable Items

If you wish to create and/or update Invoice Billable Items for all Equipment in SecurityTrax, this is easily done by using the "Sync Equipment To Invoice Billable Items" button on the Invoice Billable Items Page.

Clicking this button will create an Invoice Billable Item for every piece of Equipment in SecurityTrax. If this Invoice Billable Item has already been created, it will update the Invoice Billable Item with the current data on the piece of Equipment.