Credit Bureaus

Credit Bureau Information

SecurityTrax is integrated with the three main credit bureaus: Experian (through Hart), Equifax, & TransUnion. Additionally, we're integrated with ADT's Credit Checks.

By utilizing your existing credit bureau account(s) you can run credit reports on your Leads or Customers right within SecurityTrax.

Specific pieces of information are needed for each credit bureau in order for the proper connections to be established. Below is a table for each credit bureau listing the required information, a description, and a sample where applicable.

*NOTE: Additional charges from SecurityTrax for this integration will apply.

If you are part of a dealer program some or all of the following steps may already be completed for you. Please contact your dealer program provider.

!ALERT: ADT users, please read this Best Practices document to troubleshoot any issues running Credit Checks in SecurityTrax.

ADT

|

ITEM |

INFO |

DESCRIPTION |

SAMPLE (where applicable) |

|

1 |

Dealer Number |

The number provided by ADT for your dealership |

12345678 |

|

2 |

Dealer Password |

The DealerWeb Sytem User Password. (NOT your DealerWeb password). |

HART

One account with HART can grant access to all three major bureaus if you have an account with each bureau. HART provides a wide variety of features related to credit reports, including adding additional logic to reports pulled. SecurityTrax uses HART solely to connect to Experian.

|

ITEM |

INFO |

DESCRIPTION |

SAMPLE (where applicable) |

|

1 |

Account |

Your HART account ID or username |

|

|

2 |

Password |

Your password to your HART account |

|

|

3 |

Product |

Select CREDIT unless otherwise directed by SecurityTrax |

CREDIT |

|

4 |

Bureau |

XPN = Experian, TU = TransUnion, EFX = Equifax. SecurityTrax uses HART solely to connect to Experian. |

XPN |

Equifax

Wendi Wagner is a Senior Account Executive at Equifax and our main contact. She can be reached at wendi.wagner@equifax.com for any additional questions regarding the information in this section.

|

ITEM |

REQUIRED INFO |

DESCRIPTION |

SAMPLE (where applicable) |

|

1 |

Member Number |

Your Equifax account number |

111XX11111 |

|

2 |

Security Digits |

Your Equifax account password |

11X |

|

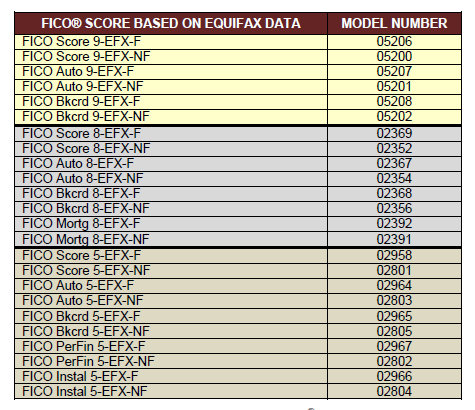

3 |

Score Model |

The type of credit report to be generated (i.e. FICO, or TELCO). These features must be turned on in your Equifax account. Additionally, you must speak with your Equifax representative to have the Score Model added to the 'MAT table' for your Equifax account. The graphic below shows the different types of Score Models available. |

02801 or 02525 |

|

4 |

Service |

Production is the functioning system. Test is the test environment. |

Production |

|

5 |

Include Print Image |

Places a copy of the credit report in the Customer Record. This feature must be turned on in your Equifax account. |

Yes or No |

|

6 |

Transaction Pin |

Not required |

Current FICO Score Models based on Equifax data:

Test Bureau

|

ITEM |

INFO |

DESCRIPTION |

SAMPLE (where applicable) |

|

1 |

N/A |

This is a test account used only by SecurityTrax |

TransUnion

|

ITEM |

REQUIRED INFO |

DESCRIPTION |

SAMPLE (where applicable) |

|

1 |

Subscriber Code |

Your TransUnion account ID (Please contact SecurityTrax and provide your TransUnion subscriber code to complete the TransUnion Credit Bureau access.) |

1111X1111111 |

|

2 |

Password |

Your TransUnion account password |

X111 |

|

3 |

Addon |

Specifies which type of credit report to pull (i.e. Vantage 3.0 or Fico Score 4) |

00V60 or 00P02 |

|

4 |

Product Code |

Identifies whether a 'soft' (08000) or 'hard' (07000) credit pull will take place. Verify your TransUnion account settings with your TransUnion rep prior to selecting a Product Code. |

07000 or 08000 |

*NOTE: To prevent any issues with TransUnion email your Subscriber Code to Support at support@securitytrax.com so it can be added to our list.

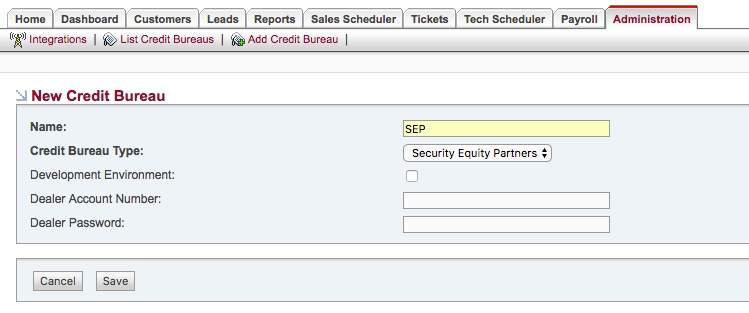

In order to add your credit bureau(s) and take advantage of this time saving feature complete the following:

- Click on the Administration tab

- Click Global Settings under the System section

- Click Integrations located under the tabs at the top

- Click Credit Bureaus

- Check the Enable Credit Bureau checkbox and click Save

- Click Add Credit Bureau located under the tabs at the top

- Enter a Name for the credit bureau

- Select the Credit Bureau Type

- Enter the applicable information for your credit bureau as described in the table above

- Click Save

- Repeat for each of your credit bureau accounts

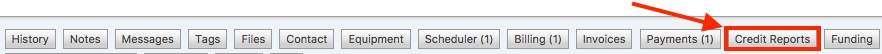

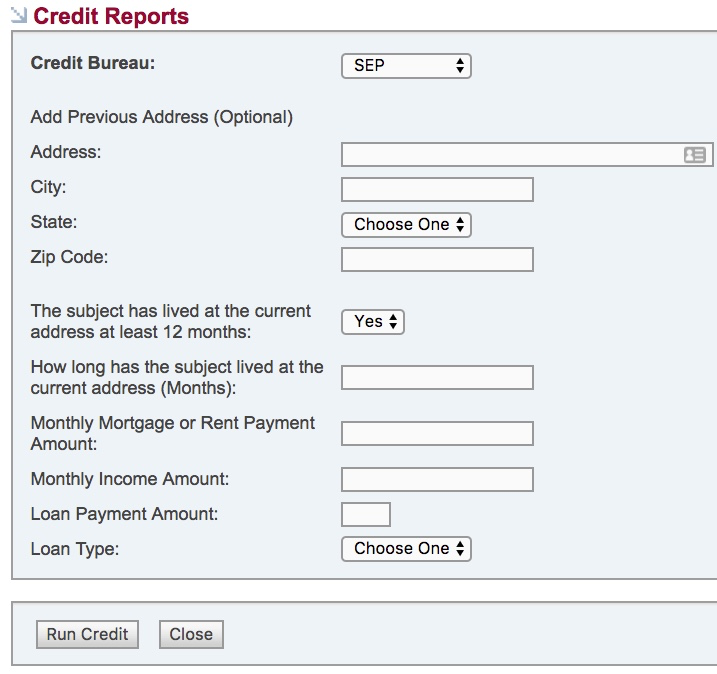

After completion of these steps you'll be able to see a button on the Customer Record labled Credit Reports. Simply click the button, select your credit bureau, and click Run Credit.

Security Equity Partners (SEP)

To set up SEP you must have Credit Reports enabled. If you do not have it enabled, you may call our support line and we can turn this feature on for you.

Once Credit Bureaus are enabled you will need to create a new Credit Bureau and input the correct credential information from SEP. This can be found if you navigate to the Administration Tab -> Integrations -> Credit Bureaus.

Once enabled assign the appropriate permissions to your user groups for access to credit reports. If you have the permissions to use credit reports you will see the Credit Reports Button on the customer button navigation bar.

When you open the Credit Reports button, Select SEP from the drop-down menu.

When an application is sent through Security Equity Partners’ integration successfully the application is scored according to the applicant’s credit history. The basic scoring involves 3 factors for an automatic approval at the time of application submission:

1. FICO is 640 or higher

2. Applicant has not filed for bankruptcy in the past 3 years

3. Applicant has not missed a mortgage payment in the past year

If an applicant’s credit history does not pass all three factors, then the application can be scored differently. Not hitting all three factors does not mean they are necessarily declined.

The possible 5 status states when an application is submitted are as follows.

| Status State | Explanation |

|---|---|

| Approved | The applicant passes all 3 scoring factors. |

| Declined | The applicant’s FICO score is 599 or lower or has been in bankruptcy in the past 3 years. |

| Approved – Pending Proof of Home Ownership | The applicant passed the FICO score and bankruptcy check, however, there are no trade lines in the credit history that show he/she is paying on a current mortgage. You or SEP will need to manually verify home ownership from the consumer or business owner. |

| Preapproved for Billing and Servicing (Optional) | Dealer can opt-in for Billing and Servicing through Security Equity Partners. Usually, an application will be declined if the applicant’s FICO score is 599 or lower. A FICO score between 600 – 639 will normally score as a Manual Review. There are three risk levels that a dealer can opt-in for. Risk Level 1: 600 and higher Risk Level 2: 550 and higher Risk Level 3: 500 and higher If the applicant’s FICO score falls within the risk level you have opted in for, then the application will be scored as Preapproved for Billing and Servicing. If you are interested in opting in for billing and servicing or wish to learn more about it, please contact SEP at (888) 501-5612. |

| Manual Review | There are two reasons an application would go into Manual Review. 1. If the applicant’s FICO score is between 600 – 639. 2. If the applicant passed the FICO score and bankruptcy check but has missed 1 or more mortgage payments in the past year the application will go into manual review. |