Sales Tax Settings

This document outlines how to configure the Sales Tax Settings within SecurityTrax.

Introduction

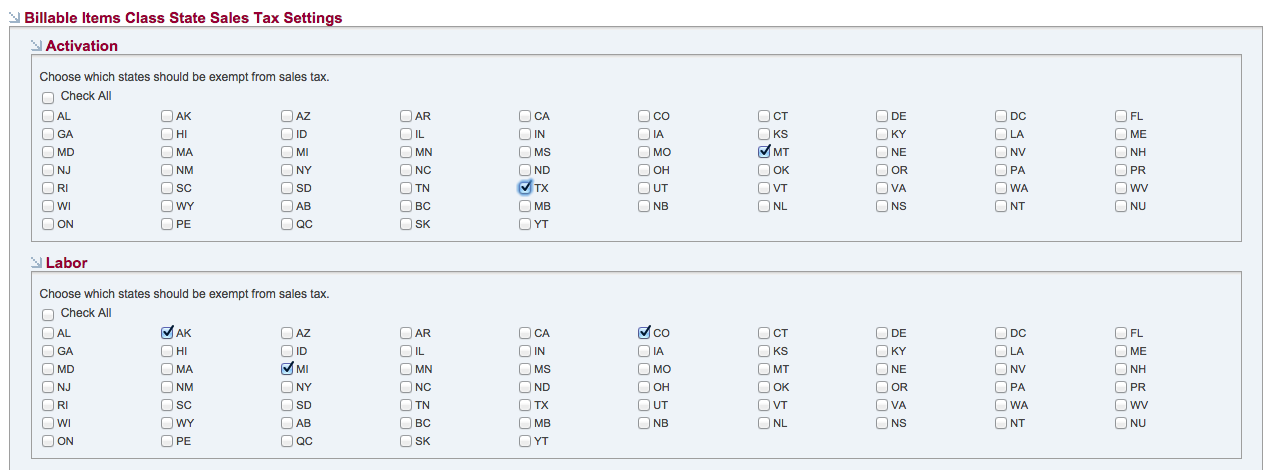

The Sales Tax Settings page provides a way to specify the states in which you are exempt from paying tax. For example, if you are exempt from paying tax on Labor in the state of Utah, checking the "UT" box in the "Labor" section would prevent taxes from auto-populating for an Invoice Line Item UNLESS the "Is Taxable" field on the Invoice Billable Item is marked as "Always".

Configuration

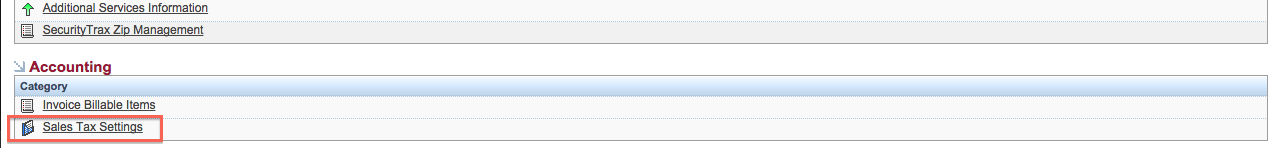

To navigate to the Sales Tax Settings page, go to the Administration tab, then at the bottom of the page find the Accounting Section and click on the "Sales Tax Settings" link.

Simply check the appropriate states and the changes will be reflected immediately after saving.